Cara Registrasi Kartu Telkomsel Baru

Cara Registrasi Ulang Kartu Telkomsel

Insurance Perks Insurance not just works well for making smart and convenient financial strategies, additionally works well for securing the absolute best future for the family members. Insurance seals the deal for a far better future and also a safe one and has lots of helpful factors also. An insurance Isn‘t about one’s own safe measure or a simple receding life, it will plenty to guard and help the longer term generation of a specific family in desperate times demanding desperate measures.

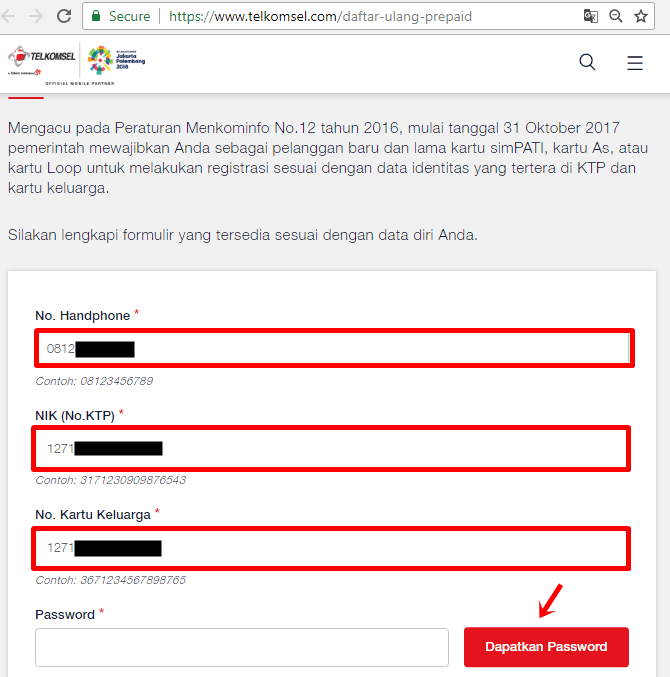

Kementerian Komunikasi dan Informatika telah mewajibkan pengguna untuk melakukan registrasi kartu SIM prabayar baik lama maupun baru untuk semua operator; Telkomsel, XL, Indosat, dan Tri mulai dari 31 Oktober 2017 sampai dengan 8 Februari 2018. Registrasi kartu prabayar dapat dilakukan dengan cara online melalui situs resmi maupun SMS ke 4444.

Here will be the few perks that come attached using the deal of Insurance Benefits. • Final expenses taken care of Insurance benefits you to chalk out the last expenses of that sort of funeral expenses or medical bills that Haven‘t been covered inside the health insurance, by satisfying means. The final of acceptable expenses such as the mortgage balance may also be covered from our advantage to your relief.

Whether it is the cremation expenditures or other kind of flooding of cash that‘s required on the legal ground, these insurance benefits manage what could be handled. • Inheritance like a blessing It‘s also been stated that owning a policy having a wishful Heir’s name like a beneficiary just to safeguard an inheritance for the dear ones is among the many perks that an insurance provides like a benefit. The death benefit also can appear like a helpful supplement to other kind of inheritance funds that you could make a decision with your rightful sense to leave within your heirs like a sign of your respective aspect in securing their future and giving them something to start with in case a predicament therefore ever arises inside the forefront.